Suggestions

Steve Hsu

Professor of Theoretical Physics and of Computational Mathematics, Science, and Engineering

Steve Hsu is a distinguished Professor of Theoretical Physics and Computational Mathematics, Science, and Engineering at Michigan State University, with a background in fundamental physics research, genomics, AI, and machine learning. He is the innovative Founder and Director of Genomic Prediction, Inc., specializing in advanced genetic testing and employing AI/ML on large genomic data sets. Additionally, he is the visionary behind Othram, Inc., focusing on the forensic application of DNA sequencing. Prior to his current role, Steve Hsu served as the Senior Vice-President for Research and Innovation at Michigan State University. He also holds the position of Scientific Advisor at BGI (formerly Beijing Genomics Institute). Steve Hsu's academic journey includes being a Professor of Theoretical Physics at the University of Oregon and engaging in entrepreneurial endeavors such as founding and chairing Robot Genius, Inc., a security software startup.

Highlights

GPT5: Time estimates for the U.S./Japan to reach self-sufficient, commercial-grade output that can meet domestic Tier-1 specs without Chinese intermediates.

(Warning: AI-generated. Expert feedback is welcome!)

The real constraints are very uneven across technology maturity, capital intensity, and, crucially, human capital and tacit know-how in process chemistry, materials science, and metallurgy.

Below I’ve ranked the materials by realistic difficulty and timescale, factoring in specialized expertise, equipment, process secrets, and industrial ecosystem depth. The time estimates are what it would take for the U.S./Japan to reach self-sufficient, commercial-grade output that can meet domestic Tier-1 specs without Chinese intermediates.

⚙️ Category A — Longest & Hardest (≥10–15 years)

- Heavy Rare Earths (Dy, Tb) and High-Coercivity NdFeB Magnets

Reason: The chemistry of HREE separation (solvent extraction cascades, >1000 stages) is empirically tuned and personnel-intensive; only a few hundred engineers globally have mastery.

Tacit knowledge: decades of process optimization in Baotou, Ganzhou; control of organic extractants, column hydrodynamics, impurity control. Downstream coupling: magnet microstructure control (grain boundary diffusion, sintering atmospheres, Dy/Tb gradient control) also depends on proprietary IP held by Hitachi Metals (now Proterial) and Chinese magnet clusters. Human-capital bottleneck: training solvent-extraction chemists + magnet metallurgists takes 5–10 years. Realistic horizon: Partial non-China magnets: 2028–2030 (Japan, U.S. pilot lines). Full heavy-REE independence: mid-2030s to early-2040s. Bottom line: this is the hardest chokepoint to replicate.

- Gallium (GaAs/GaN feedstock) Reason: Gallium is a by-product metallurgy problem: requires tuned recovery circuits at alumina/zinc smelters and downstream refining to 7N purity. Tacit knowledge: electrolyte management, organometallic precursor synthesis (TMGa, TEGa) purity control—done by a handful of Japanese firms and Chinese refineries.

Human capital: metallurgical chemical engineers with trace-impurity control skills are rare; few smelters have R&D capacity to retrofit.

Realistic horizon: Substitute sourcing / recycling: 2028–2030. End-to-end primary + 6N-7N chain: 2032–2035.

⚗️ Category B — Medium Difficulty (5–8 years typical) 3. Graphite Anode Active Material Reason: The chemistry is known; main barriers are capex and environmental permitting. Coating/graphitization know-how is moderately proprietary but transferable. Human capital: abundant in Japan/Korea/US battery sectors; training curve 2–3 years.

Realistic horizon: 2028 for synthetic, 2030 for natural HF-free full chain. Much shorter than HREE or Ga, because tacit skill is spread via global battery OEMs.

- Hydrofluoric Acid / Fluorspar Chain

Reason: Basic fluorine chemistry, but electronic-grade purification (ppt metal control) needs semiconductor-grade QA and long-cycle fab qualification.

Human capital: Japan and Korea already have process chemists; US is rebuilding this talent.

Realistic horizon: 2027–2029 for fab-qualified HF; secure 2030+. 5. Tungsten (APT → WC/Co hardmetals) Reason: Process is well understood and widely taught; China’s advantage is scale and lower energy cost. Human capital: available globally; Europe and Japan already maintain full value chains.

Realistic horizon: 2026–2028 to scale sufficient non-China production (at higher cost).

🧱 Category C — Easier / Shorter (3–5 years)

- Magnesium Metal Reason: Simple Pidgeon or electrolytic process; barriers are energy cost and CO₂ emissions, not know-how. Human capital: abundant metallurgical experience in US, EU, Israel.

Realistic horizon: 2027–2029 for commercial-scale restarts (already funded in EU, CA, AU).

- Germanium

Reason: By-product recovery and zone refining; Western smelters (Teck, Umicore) already operate. Human capital: in place; expansion constrained by feedstock availability. Realistic horizon: 2027–2028 for full independence for optics/defense markets.

🧩 Relative Timeline Summary

Rank Material / Chain Primary Difficulty Tacit Skill Scarcity Likely Non-China Independence 1️⃣ Dy/Tb + high-coercivity NdFeB Complex SX chemistry, magnet microstructure IP Extremely scarce Mid-2030s → early-2040s 2️⃣ Gallium (primary + 7N refining) By-product metallurgy, organometallics Very scarce Early–mid 2030s 3️⃣ Graphite anode AAM Coating/process tuning, capital scale Moderate Late 2020s → 2030 4️⃣ HF / Fluorspar Purity control, fab QA Moderate ~2028–2030 5️⃣ Tungsten Cost/energy, not know-how Abundant ~2027–2028 6️⃣ Magnesium Energy & CO₂ cost Abundant ~2027–2029 7️⃣ Germanium Feedstock by-product Abundant ~2027–2028

Key Insight

The timeline spread is large once human-capital depth and proprietary process know-how are included:

Short (3–5 yrs): Mg, W, Ge — straightforward metallurgy, skills exist. Medium (5–8 yrs): graphite anodes, HF — engineering-intensive but teachable. Long (10–15 yrs): Ga, Dy/Tb magnets — tacit chemistry + limited trained experts.

YAWN 🥱 RARE EARTH METALS

Wordcel Alert: Journalists, "economists", and think tank "analysts" trying to understand rare earth metals.

Japan had 15 years to address its strategic reliance on Chinese rare earth metals. They adopted a "whole of government" approach. What was the outcome?

Sometimes it is reported that Japan reduced its China reliance from ~90% to ~60%, but this is the usual sloppy wordcel kind of "analysis" 🤡

Japan really tried (Gemini):

Following a 2010 Chinese export embargo, Japan implemented a comprehensive national strategy to enhance supply chain resilience. This strategy, spearheaded by the government-owned Japan Organization for Metals and Energy Security (JOGMEC), includes several key initiatives:

International Partnerships: Japan has invested heavily in alternative sources, most notably a strategic partnership with the Australian rare earths producer Lynas, which now supplies a significant portion of Japan's light rare earth needs. Other sources have been developed in Vietnam, India, and Thailand.

Stockpiling: Japan established strategic government reserves for critical minerals to buffer against future supply shocks.

Technological Innovation: The country has focused on developing technologies to reduce the amount of rare earths used in products (e.g., in air conditioners and EV magnets) and to promote recycling (urban mining).

But what is the real situation in 2025, after 15 years of concerted effort by Japan? (Gemini)

For the processing of specific heavy rare earth elements and for materials used in the semiconductor industry Japan has particularly high, near-total dependence on China.

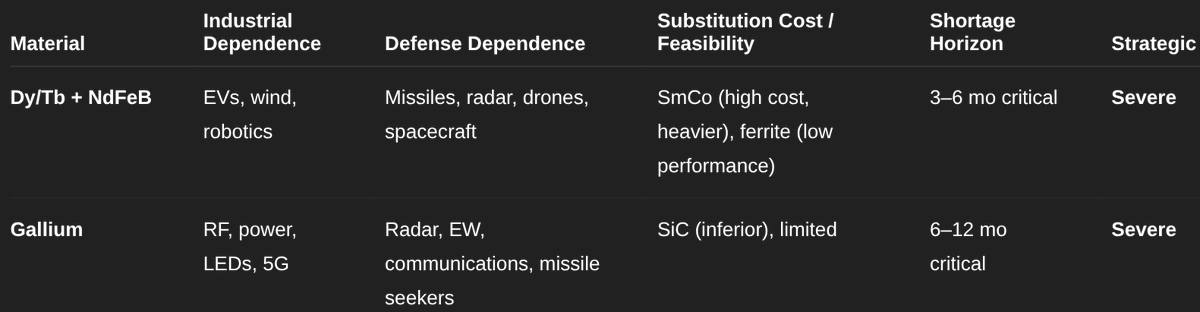

Materials with Near-Total Dependence

Magnesium: Japan relies on China for an estimated 99% of its high-concentrate magnesium supply. Magnesium is a key material used in alloys to strengthen aluminum, critical for making vehicles and other products lighter (especially important for electric vehicles).

Heavy Rare Earth Elements (Dysprosium and Terbium): While Japan has diversified overall rare earth mining sources, China still controls almost 100% of the world's supply and processing capacity for certain heavy rare earth elements like dysprosium and terbium. These are vital for the high-performance permanent magnets used in hybrid/electric vehicles, wind turbines, and defense systems.

Gallium: China produces approximately 98% of the world's gallium. Gallium is essential for manufacturing compound semiconductors (e.g., gallium arsenide) used in high-frequency applications, solar panels, and LED lighting. Japan is one of the largest consumers of gallium globally.

Germanium: China dominates the global supply of germanium, producing about 60% of the world's supply and maintaining a dominant position in refining. Germanium is used in fiber optics, infrared optics, and some semiconductor applications.

Semiconductor Supply Chain Materials

The materials above are critical inputs for the semiconductor industry, among others. China's dominance in raw material processing and refining capacity creates a significant vulnerability for the entire global tech supply chain, including in Japan.

China's ability to impose export controls on these materials (as seen with gallium and germanium in 2024-2025) highlights the risk associated with this high degree of dependence.