Suggestions

Rajan Bajaj

Founder & CEO, slice

Rajan Bajaj is the Founder & CEO of slice, India's leading credit card challenger, with investments from Tiger Global & Insight Partners. slice is revolutionizing payment solutions in India with a focus on simplicity and efficiency. Rajan Bajaj is committed to providing a seamless payment experience through innovative products like the slice card and prioritizes exceptional customer service. With a background in Civil Engineering from the prestigious Indian Institute of Technology, Kharagpur, Rajan Bajaj has also worked at esteemed organizations like Flipkart.com and Walmart in various capacities.

Highlights

If AI pushes interest rates toward zero, most retail banks won't survive. The ones that survive will charge you to hold your money

Currently incumbent banks need 3-4% interest on customer balances to survive. In the US, with 1-year treasury at 3.5%, they pass 0.5-1.5% to customers. In India, with 5.5% repo, they pay 2.5-3% on savings

If treasury rates fall to 1-2% for extended periods, even paying customers 0% won't be enough. Current cost structures can't survive

Is this realistic? If you're in the business of risk, you have to treat AI-driven deflation as a non-zero probability. Banks need to treat it as a core risk

The path to resilience: operate on margins low enough to pass 80–100% of treasury yields to customers. Without that, the bottom 90% of banks get wiped out

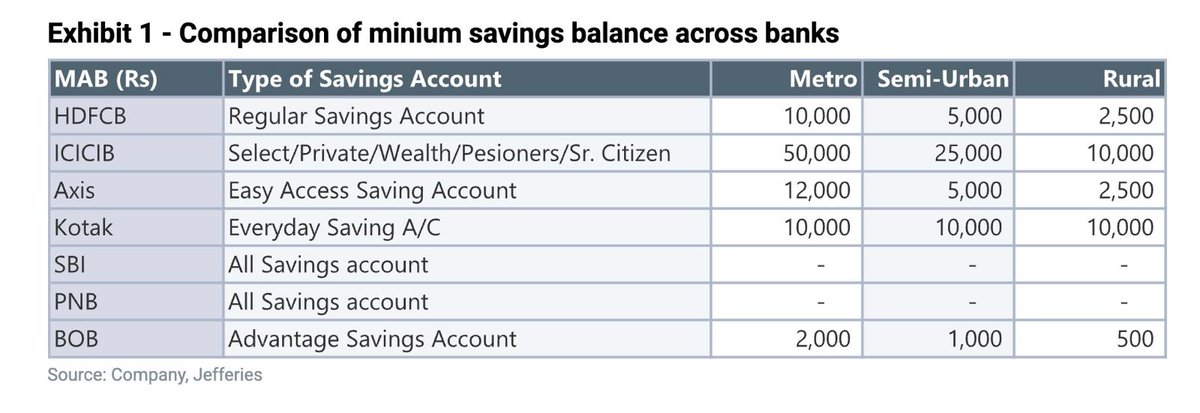

Something fundamental is happening to savings bank accounts in India. The rules we grew up with – minimum balances, interest rates, and even what it means to save – are all changing.

For decades, banks paid us very less on savings. It was the price of instant access to money and all those branches and ATMs. But we live in a different world now. Getting your money quickly doesn't cost what it used to. You can put funds in liquid investments that pay close to repo rates and still withdraw instantly (with some limits). So why accept half that rate from your bank?

As people wake up to this, they move money from low-paying savings accounts to these better options. The old spread is becoming visible arbitrage. Banks talk about their costs. Customers care about results. They want their money fast, they want clarity, and they want a fair return. Your operating expenses aren't their problem. Banks need to match what's already available in the market. If they don't, money will keep flowing elsewhere.

Exceptions exist: customers holding much more than ₹5 lakh in savings, or those who need superb branch support, may still choose lower-yield savings because of trust and convenience. For everyone else, market reality sets the benchmark, and pricing and experience will have to line up with it or customers will self-select out.

The same thing is happening with credit. Tech-forward NBFCs spend less per loan because they've built better systems and faster processes. Right now, their higher funding costs keep them in different segments. But when that gap shrinks to about 1.5-2%, they'll come for the banks' best customers.

With better UX and speed, great customers drift and banks face selection bias and a worsening risk mix. It is no longer only about cost; it is also about portfolio quality as the market matures. These NBFCs are moving into mortgages, the primary territory for banks, so expect similar cost and experience arbitrage in home loans as digital and AI-first models scale.

Zooming out, think from the point of view of money. Money wants to move fast, to create lot of optionality, provide value and to not depreciate. If banks build low-cost, high-tech money software around those needs, they can serve not only credit but also investments, payments, and commerce. There is a layer above banks that many have built, yet as the base layer of the money system, banks can often deliver these tools at lower cost and with wider reach.

Do right by the money and the customer will follow. Solve the money software well and deposits deepen, credit flows to better segments, and sustainable fee income emerges. Because banks are the manufacturing layer for deposits and credit, they can keep pushing unit costs down and take these tools to the mass market.

India is on track to become the world’s number 3 economy by GDP, yet our financialisation still lags. If banks build this system well, it can drive a step change and push India into the global top 10 for financialisation. Lower costs that are good for business and good for the country. More people find these tools useful, and banks grow on deposits, credit, and at-scale fees even if per-customer fees are smaller. That is the way!