Suggestions

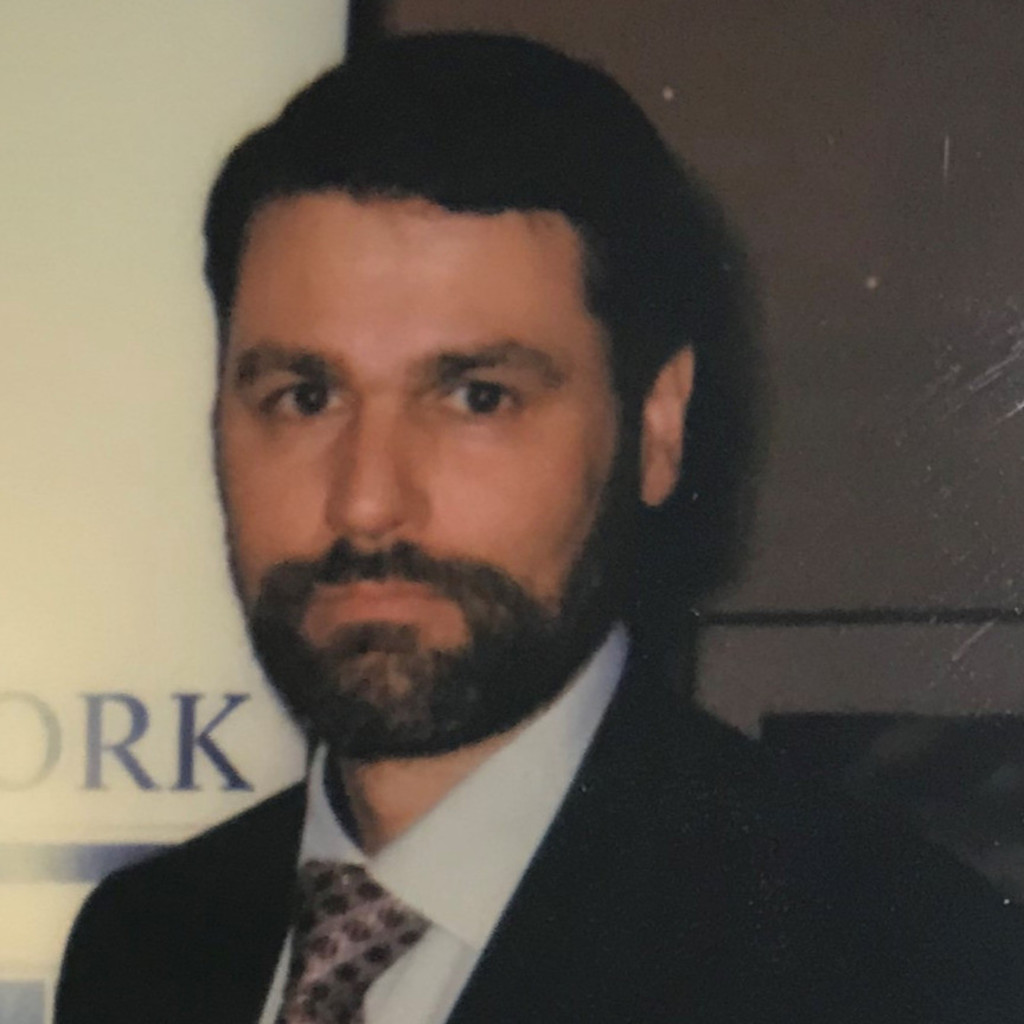

Markus Matuszek

Managing Partner, Chief Investment Officer at M17 Capital Management

Markus Matuszek is a prominent investor and entrepreneur, currently serving as the Chief Executive Officer and Chief Investment Officer at M17 Capital Management, a market-neutral fund that primarily focuses on European investment opportunities. He founded the firm, which specializes in long/short value positions and private investments, aiming to acquire ownership stakes in companies to maximize their long-term potential through active collaboration with management and shareholders.1

Professional Background

Before establishing M17 Capital Management, Markus held significant roles in various financial institutions:

- Hermes Capital Management: Managing Partner, where he focused on value investing across multiple asset classes.

- Gabelli & Partners: Managing Partner, involved in hedge fund management and investment research.

- McKinsey & Company: Began his career as a consultant, gaining expertise in strategy, restructuring, and corporate finance.12

Education

Markus Matuszek holds an impressive educational background:

- M.A. in Finance, Accounting, and Controlling from the University of St. Gallen, Switzerland.

- Dual MBAs from Columbia Business School and London Business School, both with honors.

- Additional studies at the Warsaw School of Economics and the University of Geneva.1

He is also a CFA charterholder, reflecting his commitment to high standards in investment management. Additionally, he participates as a jury member for the CFA Institute’s Research Challenge in Switzerland and EMEA.2

Investment Philosophy

At M17 Capital Management, Markus emphasizes a flexible investment approach that includes:

- Seeking controlling positions in stable companies undergoing change.

- Willingness to invest in distressed situations when long-term value creation is evident.

- A focus on rigorous risk management to limit drawdowns while pursuing high return rates.13

Markus Matuszek's extensive experience and strategic vision position him as a key figure in the investment landscape, particularly within European markets.