Suggestions

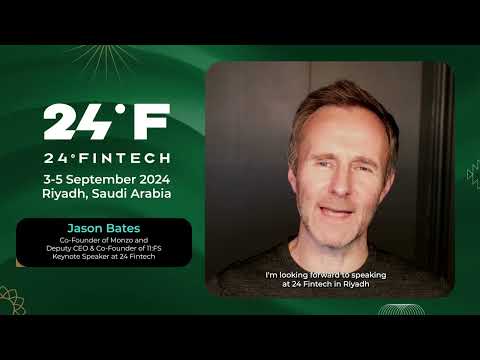

Jason Bates

Co-founder at 11:FS & Monzo | Consultant | NED | Speaker

Jason Bates is a prominent figure in the fintech industry, known for his roles in co-founding and leading several innovative digital banking ventures. Here's an overview of his career and accomplishments:

Career Highlights

Jason Bates is currently the Co-founder and Deputy CEO of 11

-

Monzo: As Co-founder and Chief Customer Officer, he led customer and product development, branding, and social media efforts. He played a key role in naming the bank, launching its acclaimed alpha banking app, and defending the value proposition to UK regulators.2

-

Starling Bank: As Co-founder, he spent a year designing and developing the proposition and product for this digital bank. His responsibilities included brand development, marketing, and product design.2

Professional Experience

-

11

: As Deputy CEO and Chief Product Officer, Jason leads delivery teams helping banks drive digital transformation and implement innovative changes.1 -

Corporate Startup: He briefly served as CEO & Head of Product, working on digital innovation projects for companies like Nectar, Sainsbury's, and BP.2

-

Freeformers: Co-founded this digital transformation company focused on helping corporate executives understand digital technologies.2

-

Accenture: Worked as a Systems Architect and later in the European Ventures and Alliances group.2

Expertise and Influence

Jason is recognized for his expertise in:

- Digital banking and fintech trends

- Product design

- Next-generation financial services

- Building digital banks from scratch1

He co-hosts the FinTech Insider podcast, covering the latest news and trends in fintech and financial services.1

Education and Additional Roles

Jason holds a degree in Philosophy, Politics, and Economics from the University of Oxford.2 He has also served as a member of the board of Trustees for Sunday Assembly, a social enterprise focused on community building.2

Jason Bates's career trajectory showcases his significant contributions to the digital transformation of banking and his ongoing influence in the fintech sector.