Suggestions

Itai Damti

Experienced Entrepreneur and CEO

Itai Damti is the Co-Founder and CEO of Unit, a company that provides an embedded finance platform to help tech companies build banking and lending features into their products.1 Here are some key details about Itai Damti:

Professional Background

Current Role::

- Co-Founder and CEO of Unit since April 20192

Previous Experience::

- Co-founded Leverate, a technology provider for online brokers, growing it to 160 employees and $100 billion in monthly trading volume12

- Entrepreneur in Residence at 500 Startups (Fintech) and HAX2

- Co-founded 2n, a quant prop-trading business2

- Software Engineer & Architect in the Israel Defense Forces (IDF)2

Expertise and Interests

- Fintech and embedded finance

- Technology and software development

- Startups and venture capital

- Mentoring and advising early-stage startups12

Education and Skills

- Studied at The Open University2

- Proficient in English and Hebrew (native or bilingual proficiency)

- Elementary proficiency in Chinese2

Entrepreneurial Philosophy

Damti is known for his focus on precision and high-impact decision-making in building financial technology.6 He emphasizes the importance of infrastructure in fintech innovation and sees regulatory scrutiny as a sign of a maturing ecosystem that can lead to more clarity and confidence in the industry.5

Itai Damti is actively involved in the fintech community, often speaking at industry events and podcasts about the future of embedded finance and software-driven fintech solutions.34

Highlights

Today we’re making @unit_co_'s biggest announcement to date: ready-to-launch solutions.

They help software companies offer a full money dashboard to their customers: capital, banking and bill pay ✨

We’ve built ready-to-launch to make it the simplest to launch + succeed in embedded finance:

- Build: 1 line of code expands into a full money dashboard for your customers - capital, banking and bill pay. You can start with just ONE of these.

- Operate: fully managed customer support.

- Profit: revenue share + no exposure to fraud losses.

- Succeed: marketing materials that drive adoption, including automatic emails + hosted content.

WHY?

There are 36m+ small businesses in the US. For them, money boils down to 4 tasks: (1) get capital (2) get paid (3) manage my money (4) pay others. That’s all they need - ideally simply, and in one place.

The THEORY of embedded finance: software companies are in the perfect position to solve this. They already do (2) - accepting payments - so why not expand to the other 3 tasks and become the all-in-one money dashboard?

The REALITY is usually messy. Software companies aren’t experts in building money solutions. Building strong, secure and responsive UX is a multi-year commitment, even with great infrastructure. Building support + fraud is hard and expensive. It takes time to drive adoption with the right marketing and terms. Thinking about a new product, like capital? It’s a whole new journey.

WHAT IS IT?

Just watch the short videos on our blog post 👇

In a nutshell:

🪙 CAPITAL: your customers will be pre-qualified automatically and can apply for a line of credit, like $50,000 to pay vendors. They can draw funds into any bank account.

💳 BANKING: your customers can manage multiple accounts, invite team members and give them cards, deposit checks, send + receive payments, connect to Quickbooks & Xero, or connect to Venmo + others via Plaid.

📰 BILL PAY: your customers can upload invoices, choose when + how to pay them, manage approvals + vendors, and connect to Quickbooks & Xero.

You can start with just ONE of these, and add the others over time. When you do, really powerful things happen. Example: banking + bill pay = cash flow projections. Which allows capital to be offered and delivered just-in-time. That’s small business magic ✨

LOOKING AHEAD

Ready-to-launch is now a new implementation path, alongside our “custom build” path.

The feedback from customers that chose it teaches us that we’re entering a new era in embedded finance.

One thing we’re excited about is helping software companies “read and write”: push data into this money dashboard, and pull data from it to give more value to their customers. What if your restaurant software helped you place a new order with a napkin vendor once stock is running low? Categorize your expenses? Or do your accounting & bookkeeping for you?

That’s where embedded finance is going, and we’re excited to build that future 🏗️

More + video demos: https://t.co/cc76CSkE2n

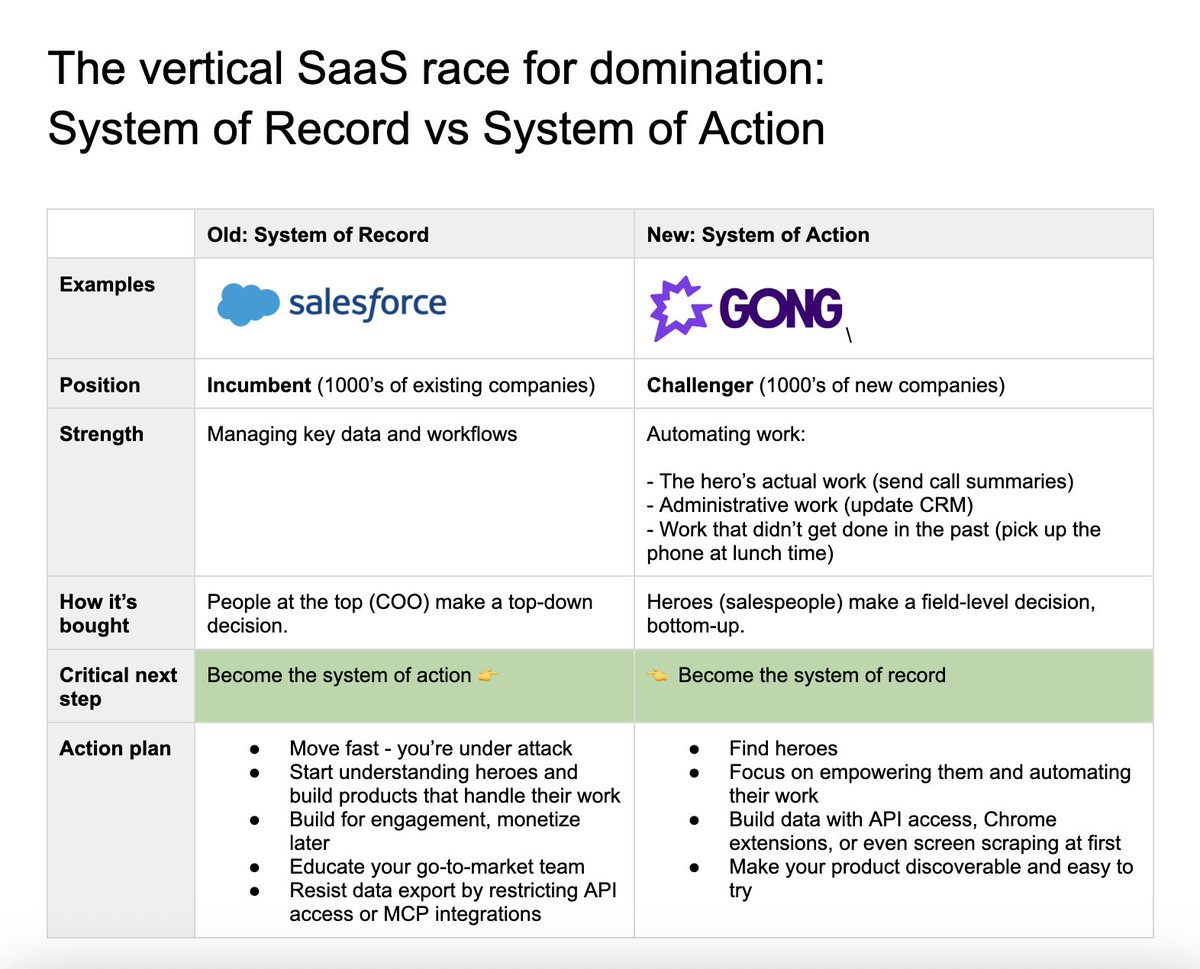

Great read for vertical SaaS leaders: @davelyuan (@tidemarkcap) just dropped a fantastic post on the race to become the “system of action”.

Link: https://t.co/XhnEqkGyQA

The key idea: AI created a new wave of tools in vertical SaaS - SYSTEMS OF ACTION. They typically attach themselves to existing tools, or SYSTEMS OF RECORD. These new tools serve “heroes” and automate their work. They’re quickly gaining ground in vertical SaaS, and over time they’ll fight to extract data, become the system of record and dominate their industry.

The best example I can think of from my work isn't vertical SaaS per se: it’s the war to dominate sales tooling between Salesforce and a newer generation of tools like @Gong_io and @clay_gtm. I compare them in the image below.

An example from vertical SaaS: I recently met a property management software company that grew to serve 700+ customers in <2 years. How? By automating ALL the coordination around maintenance requests: pick up the phone when a resident needs service, assign the right professional, make sure the work is done. That's a system of action.

It’s very likely that thousands of systems of action will be new winners in vertical SaaS that no one saw coming. And it’ll be a fierce battle between them and the incumbents.

I love the way Tidemark has been building content: valuable, long form pieces, a growing body of terminology ("control points", "system of action") and telling leaders exactly how to execute - without taking sides.