Suggestions

Conor Witt

Investor at Upper90

Conor Witt is a dynamic and accomplished early-stage debt and equity investor with a robust specialization in the fintech sector, as well as commerce, supply chain, and marketplace businesses. With a keen focus on Seed to Series B funding, Conor is deeply involved in supporting visionary founders who are shaping the future of these industries. His extensive experience in investment and analysis provides him with the unique capability to identify and nurture promising startups, playing a pivotal role in their growth and success in a competitive market.

His journey in the finance and investment sector began at the prestigious University of Virginia, where he pursued a Bachelor's degree in Politics. This foundational education not only equipped him with crucial analytical skills but also instilled a deep understanding of economic policy and its implications on business practices. Prior to his time at university, he attended the Middlesex School in Concord, MA, laying a solid groundwork for his future academic and professional endeavors.

Conor's professional pathway is marked by a series of progressively responsible roles within leading organizations. As the Vice President at Upper90, he is at the forefront of innovative funding efforts, leveraging his expertise to cultivate high-potential investments. He previously held the role of Investor at the same firm, where he developed a keen eye for discerning viable investment opportunities and guiding startups towards profitable trajectories. Earlier in his career, Conor contributed significantly as a Senior Research Analyst in fintech at CB Insights, where he conducted in-depth market research and analysis, identifying critical trends that shaped the fintech landscape.

Before diving into research analysis, Conor honed his strategic insights as the VP, Strategy Lead Analyst at Citi, where he was instrumental in shaping financial strategies and optimizing investment portfolios. His role involved extensive collaboration across departments to enhance decision-making processes and drive complex financial projects to fruition. Additionally, his experience extends to writing, having worked as a freelance writer for renowned platforms like TechCrunch, where he explored the nuances of fintech and ecommerce, contributing valuable content that informs industry stakeholders.

Conor’s early experience includes significant roles in management consulting at Capco, where he specialized in advising financial institutions on operational excellence and technology adoption. His internships at Artemis Capital Partners and Akre Capital Management offered him insightful exposure to the investment world, allowing him to develop essential skills in financial analysis and market evaluation that continue to influence his investment strategy today.

As a visionary investor, Conor Witt is well aware of the rapidly evolving landscape of technology and its intersection with financial services. His hands-on experience across various sectors and roles has armed him with a wealth of knowledge, making him a sought-after expert in the innovation ecosystem.

Highlights

New Data Tapes newsletter on private credit is live

Highlights:

-Financings: Aqua Finance, Flexport, goeasy, Klarna, Oportun, Nelnmet

-Fundraises & M&A: Air Lease, Benefit Street, Bow River + Park Cities, Blackstone Infra secondaries

-Market commentary below...

McKinsey Private Markets Report 2025...

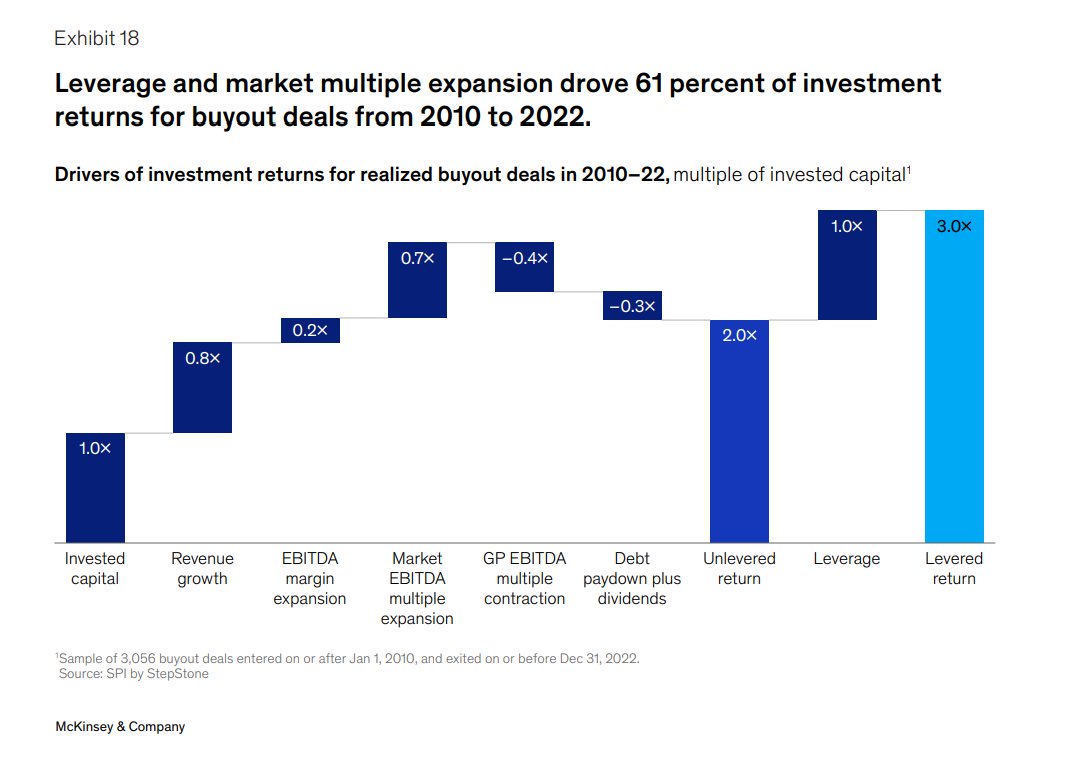

"Leverage and market multiple expansion drove 61% of investment returns for buyout deals from 2010 to 2022"

https://t.co/KGPhRuc0bl https://t.co/yh9mAniYEf