Suggestions

Connor MacDonald

CMO at Ridge.com

Connor MacDonald is the Chief Marketing Officer (CMO) at The Ridge, a digitally native e-commerce brand specializing in men's essentials, most notably known for their Ridge Wallet.1 Here's an overview of his background and career:

Education and Early Career

Connor studied Business Management & Economics as well as Film & Digital Media with a Production Concentration at the University of California, Santa Cruz, graduating in 2016.2 He began his career in marketing as a Content Marketing Intern at Branding Los Angeles in 2014.3

Professional Journey

After graduation, Connor worked in various marketing roles:

- Content Marketing Manager at Hawke Media

- Digital Marketing Consultant (freelance)

- Managing Partner at Top Hat Ventures, a boutique agency he co-founded12

The Ridge

Connor joined The Ridge in 2017 as part of their Digital Strategy team.2 In January 2019, he was promoted to CMO, a position he continues to hold.2 At The Ridge, Connor:

- Manages all marketing efforts across various platforms, including website design, Facebook, Google, TV, and direct mail1

- Leads a team of 25 people

- Helped grow the company to $32 million in revenue (as of 2020)1

Achievements

Under Connor's leadership, The Ridge has:

- Been recognized as one of Inc.'s top 1000 fastest-growing companies1

- Expanded its product line beyond wallets to include other men's essentials

- Grown to serve over 2 million customers with their flagship Ridge Wallet4

Connor is known for his expertise in digital marketing, e-commerce strategies, and his ability to scale brands effectively in the competitive online retail space.

Highlights

There is no more degenerate behavior than not using Slack threads

We spent tens of millions on ads in the last 60 days to end a record-setting Q4 at Ridge.

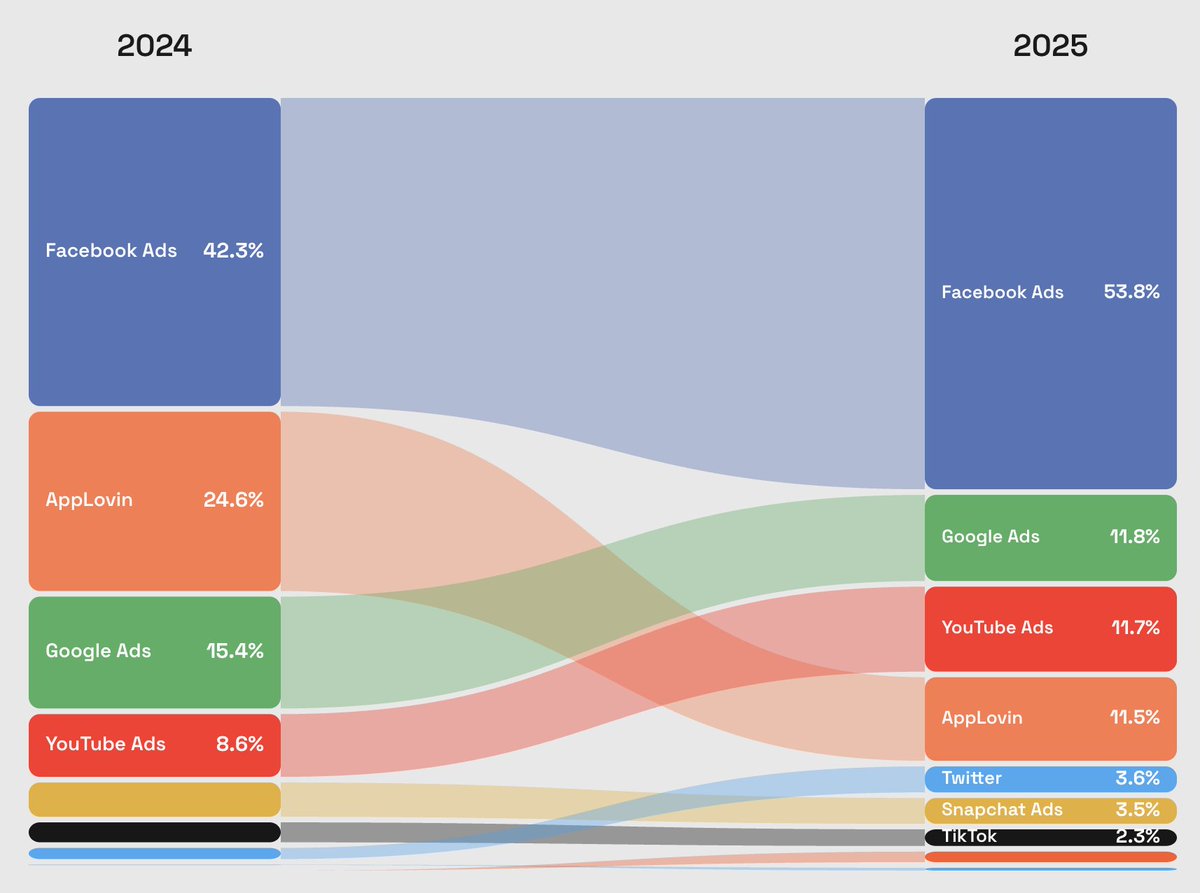

I did a quick exercise to look at share of budget changes YoY, and its a great synopsis of what we're seeing on the performance front.

Here's how things changed and a few of my takeaways and goals for next year.

to note: this is paid social platforms YoY for our EDC business. We spent significantly more YoY, so even % decreases are mostly net $ increases. It also does not include partnerships or TV budgets.

Here's the graph with 1DC ROAS layered in — we saw efficiency improvements on basically all fronts:

To get channel specific:

1/ Meta is always the elephant in the room.

It performed terribly in 2024, and at 42% TTL LY it was at its smallest share of budget for any November.

We saw a 30% increase in ROAS in 2025, including non-purchase optimized campaigns that we've validated drive low 1DC ROAS yet are highly incremental.

It's a huge win getting back to 50%+ TTL

2/ Interestingly, a consistent win across channels is an increase in CTR YoY, reducing cost of traffic while largely maintaining AOV/ECR

Some of these very dramatic shifts are explained by different placements — more search than shopping, more in-stream than YT Shorts, etc etc

3/ AppLovin was extremely underpriced last year and took up a huge % of budget

While its still a 7-figure channel for us, there was no way it would maintain its % of total spend.

I was surprised it essentially maintained ROAS YoY, after being an extremely efficient channel LY.

Overall it is still a seasonal channel for us and mostly activated during gifting periods, but we think we can unlock it on an evergreen basis in 2026.

4/ YouTube is potentially our most significant win YoY,

We came into this year with a focus on horizontal video — unlocking in-stream YouTube Ads & linear TV — and getting to 10%+ of budget well above target makes it a great alternative to Meta and I believe drives a lot of downstream value.

5/ Twitter has performed surprisingly well since October and ended up at 3.6% TTL budget.

They've very publicly improved a lot of the platform, and the ad performance seems to have come along with that.

6/ TikTok was flat YoY as a % TTL despite ROAS improving significantly. I think its probably one of our biggest opportunities for further paid social scale.

7/ Finally, the tiny bars are Reddit and Microsoft!