Suggestions

Carl Richards

Creator of the Behavior Gap

Carl Richards is the Chief Brand Officer at Elements, a software company for advisors.1 He is also the creator of the Sketch Guy column, which appeared weekly in The New York Times for a decade.4 Carl is a Certified Financial Planner™.235

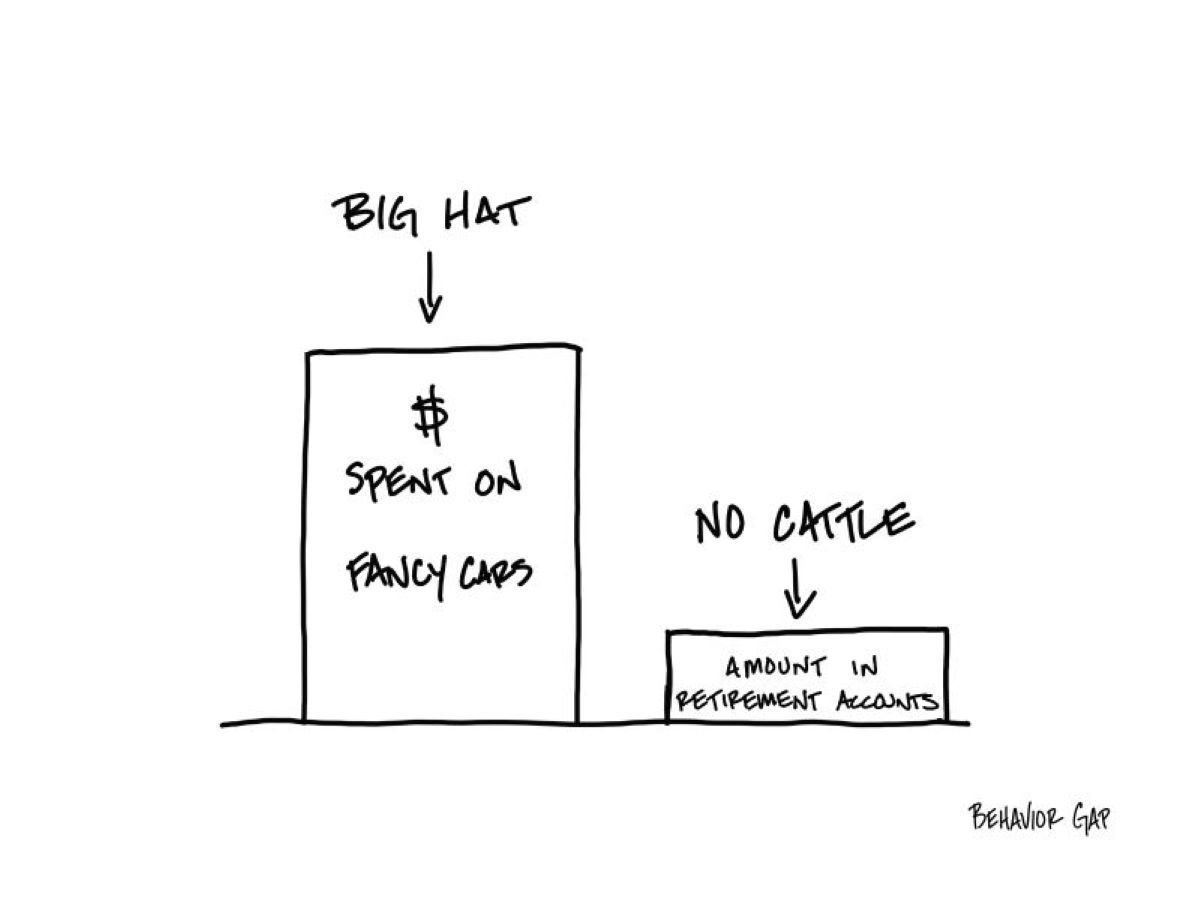

Richards uses simple sketches to explain complex financial concepts.245 These sketches form the basis of his books, The One-Page Financial Plan: A Simple Way to Be Smart About Your Money and The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money.245

Carl's sketches have been showcased in exhibitions at the Kimball Art Center in Park City, Utah, Parsons School of Design in New York City, The Schulz Museum in Santa Rosa, California, and the Mansion House in London.45 His work is also on display in businesses and educational institutions globally.45

Before becoming Chief Brand Officer at The Elements Financial Monitoring System™ in January 202246, Carl Richards held positions such as:

- Financial Advisor at Prudential Securities (1996-1999)6

- Wealth Manager at Merrill Lynch (1999-2004)6

- Founder of Clearwater Asset Management (2004-2009)6

- Director of Research at TCI Wealth Management (2008-2009)6

- Founder of Prasada Capital Management (2010-2012)6

- Director of Investor Education at BAM Advisor Services (2012-2016)6

Carl Richards graduated from the University of Utah - David Eccles School of Business with a Bachelor of Science in Finance (1993-1997).46

Highlights

We all carry an invisible number above our head.

At some point, the number stops being information and starts being something we defend.

We protect it. Grow it. We become obsessed with comparing it.

That’s rarely where clarity lives.

👉 You can pick up your copy on Amazon or wherever you buy books. https://t.co/9I2QQ8pyUz If you’re in the U.S. and ordering for a firm, team, or event, you can purchase bulk copies at a discount here: https://t.co/MW3H14E023

Most conversations about taxes start too late.

This sketch shows the difference... On the left are the taxes you paid. On the right are the taxes you could have paid.

That gap is not about loopholes or clever reporting. It is about planning... or the lack of it.

Good tax work happens upstream. Before the sale. Before that big decision is final.

Once you see this distinction, it is hard to unsee it. And it changes how you talk with clients about what actually matters.

→ This sketch is available as a digital license if you want to use it in client conversations, presentations, or internal training. This art is meant to be used. https://t.co/SHsF2QuMjt